I know it’s sort of silly to be talking about taxes in the middle of the year but because my blog has become my business over the years, taxes are always on my mind and it’s never too late, or early, however you look at it, to get your taxes organized.

Did you know you’re supposed to keep a copy of your taxes for 7 years! It’s crazy, I know, but this method for organizing your taxes will make it easy for you to keep them organized and cut down on some of the paper clutter, which is always a good thing!

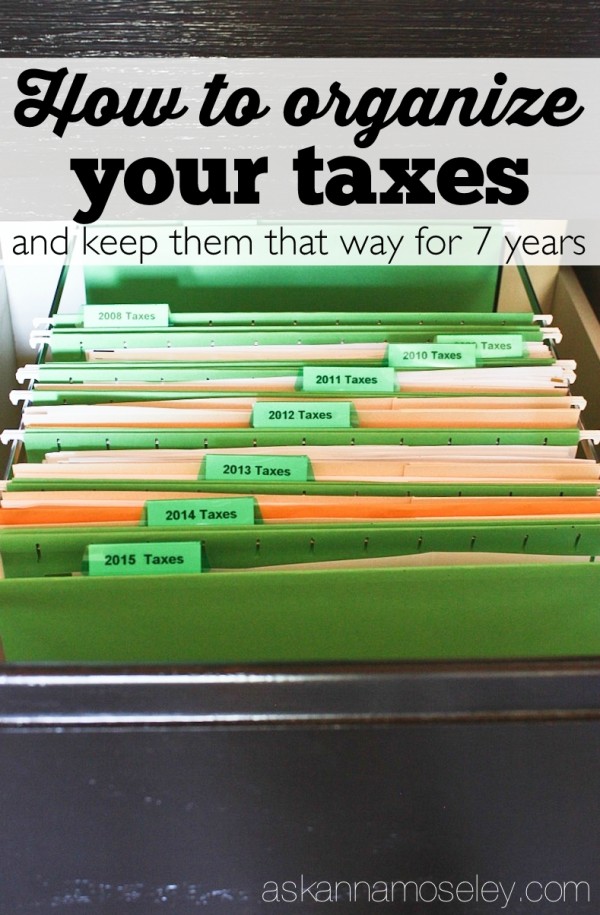

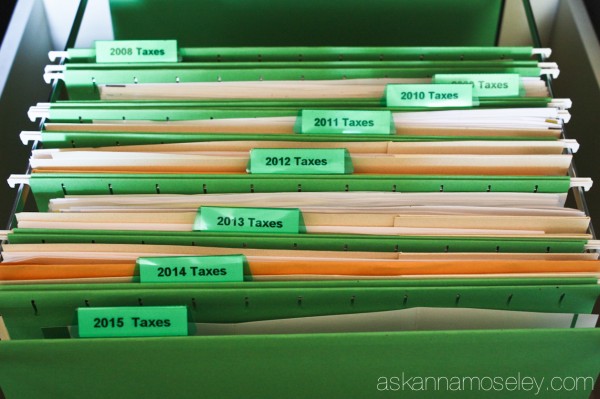

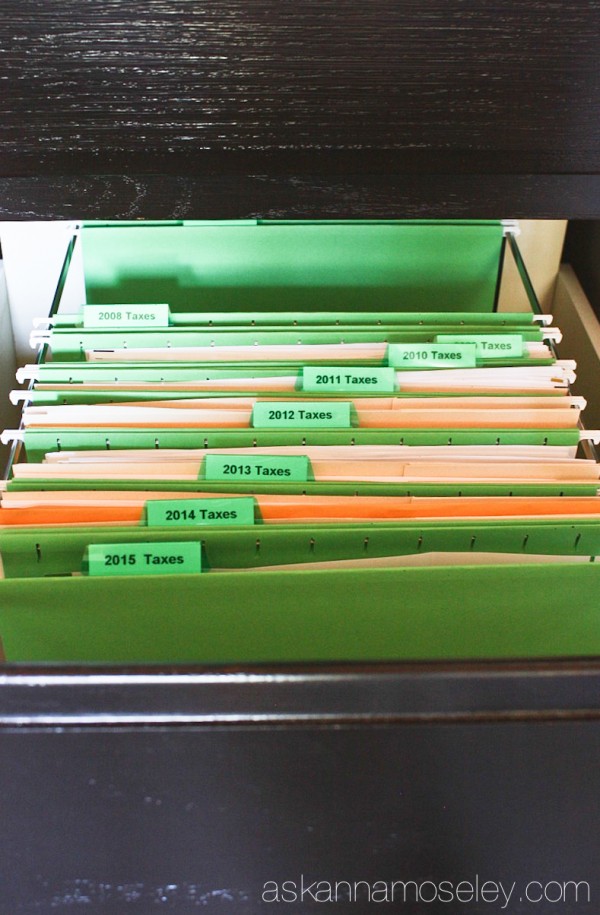

I bought these rainbow file folders from Amazon and assigned a color to each thing in my filing cabinet, our taxes got green because money is green. 🙂

Then I used my label maker to assign each folder a year. I used to keep all our taxes in one huge folder but it was so messy. Putting each year in its own folder has made it so much easier to keep them organized and find something when I need it!

The other thing I used to do was keep all our 1099s, W4’s, letters and receipts from each year (a crazy amount of papers) but did you know that all you have to hold on to for those seven years, are your actual filed taxes? So hang onto the state and federal tax return papers and toss everything else! It’s really okay because everything is already on the tax return itself. This will drastically reduce the amount of space your taxes take up and it will be a huge relief to get rid of all that unnecessary clutter. 🙂 (Our folders are still a little big but it’s because our accountant prepares a huge folder for us.)

The other thing that’s important is to have a place for the current year’s papers to be filed. If you don’t have a designated folder for them you are likely to lose important receipts or documents. Every year, after we file our taxes, I shred everything in the folder from the 7th year, and relabel it with the current year. For example, last year I shredded everything from 2007 and used that folder to create my 2015 tax folder.

Having a current year folder makes it easy to keep track of important documents you get throughout the year, like donation receipts, etc. It also makes it really easy when tax season rolls around because all the papers you need to file your taxes are already compiled in one organized file! I know my husband loves me but I think the banker side of him loved me even a little more when I started organizing our taxes this way because it made preparing our taxes so much easier!

Our tax folders share a filing cabinet with our bills, which I shared how to organize those last week. If you didn’t see the post, you should definitely check it out because it’s another great method of organization that will also really help you cut down on paper clutter! Click HERE to read that post.

Doesn’t it feel so good to finally get rid of all those papers and receipts that you’ve been hanging onto for all this time!? It makes me feel so much lighter and now when I open our filing cabinet I don’t cringe, I actually smile because it’s pretty and so organized!

Disclosure: I have included affiliate links in this post but if you purchase through them you will not pay a cent more than you would otherwise. Thank you for supporting Ask Anna!

I have so many files to keep my documents for tax filling. Its an arduous task to keep them in check.

First, I would like to say that I enjoy reading your blogs, they are very helpful. However, I disagree about throwing out the supporting documents. Here is why:

I was audited by the IRS and had to send them a copy of the 1099 showing the correct smount on a tax return from 2 years ago. Apparently, they had the original 1099 and not the corrected one which showed a large difference that could make us have to pay over a thousand dollars than what we already paid. It was a good thing that I still had it from a couple years back.

I do have a quick solution that I got from yiu and that is to scan those supporting documents.

Being an accountant, I noticed that you said to toss all of the backup for the tax file. Not a good idea. If you are audited, and that is why we keep the tax file 7 years, you will have to prove all of your deductions and income. DO NOT, I repeat DO NOT throw away your backup.